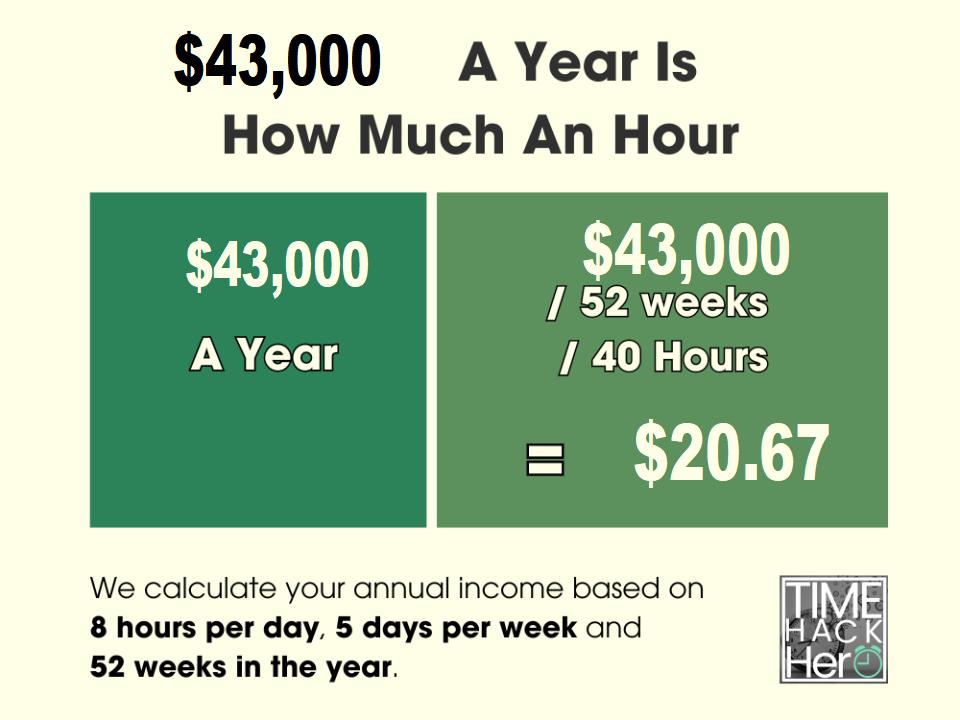

So, if you’re makin’ $43 an hour, ya might be wonderin’ how much that is in a whole year after taxes. Well, lemme break it down for ya in simple terms. If ya work 40 hours a week, and workin’ all 52 weeks in a year, here’s what ya need to know. At $43 an hour, you’d be pullin’ in about $89,440 before taxes in a whole year. That’s just simple math, you see – 43 bucks an hour, times 40 hours a week, times 52 weeks a year.

How Much Is $43 an Hour in a Year After Taxes?

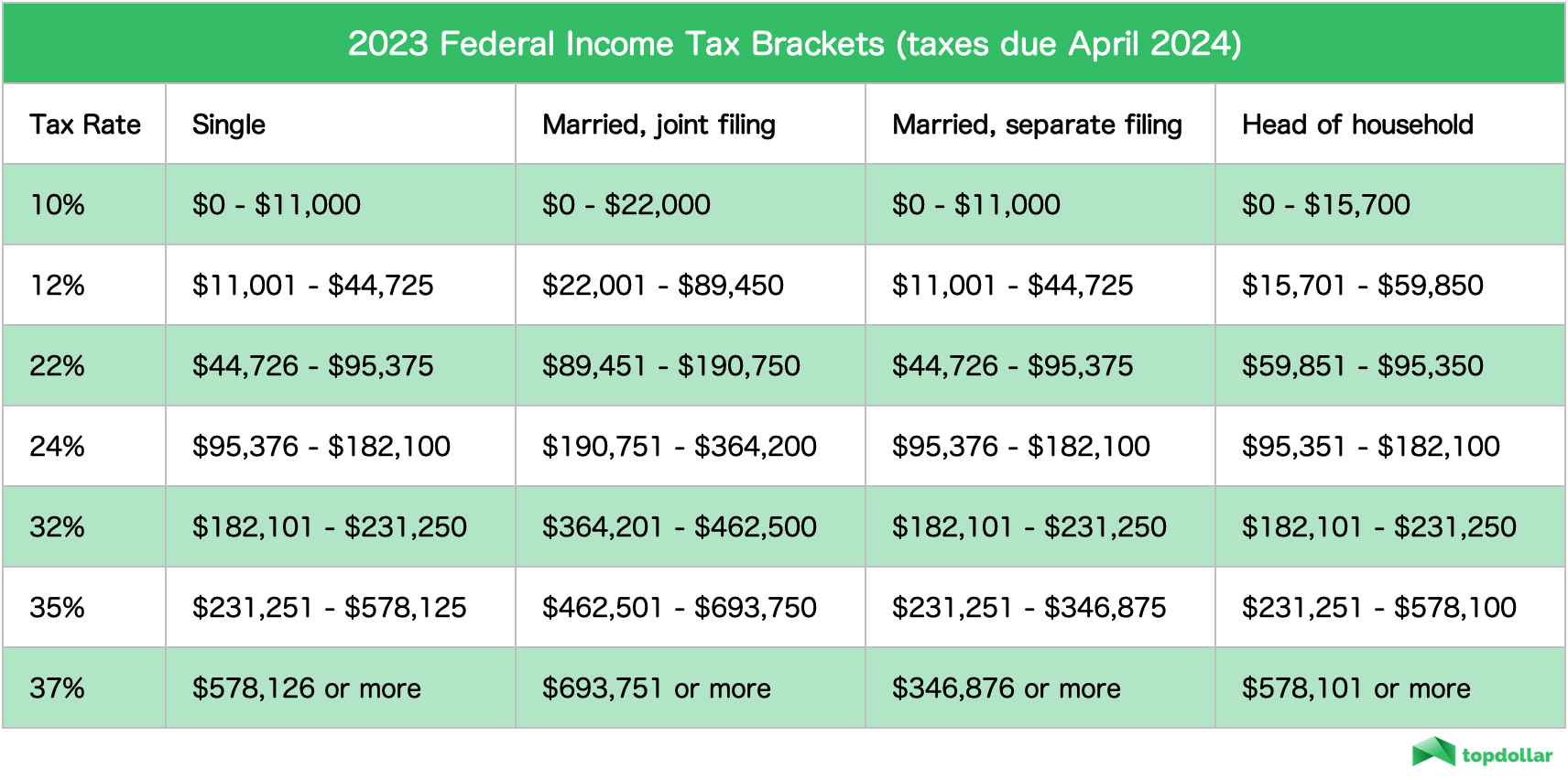

Now, if you wanna figure out what that looks like after taxes, it gets a little tricky. You see, the government takes its cut. Let’s say you got a 21% tax rate – that’s kinda average for folks in the U.S., though it might change depending on where ya live. With that 21% taken off, you’d be lookin’ at takin’ home around $66,000 a year, give or take. So, after them taxes, you’re still doin’ alright, but it’s definitely not the full $89,440 you started with.

Now, that’s assuming you’re workin’ full time all year long. If you take some time off, or work less than 40 hours a week, well, that’ll change your numbers. If you’re workin’ part-time, or workin’ a few less hours, the yearly total will be less. But, if ya stick to the full 40 hours a week and 52 weeks a year, that’s the ballpark number you can expect to earn.

How Much Do You Make Per Month, Week, or Day?

Now, let’s break it down a little further. If you’re wonderin’ how much that is per month, week, or even day, here’s how you can figure it out:

- Per Month: If you’re makin’ $89,440 a year before taxes, that works out to about $7,453.33 a month. That’s $89,440 divided by 12 months.

- Per Week: For a weekly paycheck, you’d be lookin’ at about $1,720. That’s $43 times 40 hours a week, equals $1,720 a week before taxes.

- Per Day: If ya workin’ 5 days a week, that works out to about $344 a day, before taxes. You just divide the weekly amount by 5, and that gives ya the daily rate.

What About Taxes?

Now, like I said, taxes are gonna take a bite outta that income. If you live in a place where the taxes are a bit higher, you might see a bigger chunk taken outta your paycheck. It all depends on your tax rate. In some states, they take out more, and in some, they take out less. So, if your tax rate is 21%, like we’re usin’ here, then ya might see your annual income after taxes come out to around $66,000 or so.

Other Factors to Consider

Don’t forget, there’s other stuff that can mess with your pay. Things like health insurance, retirement contributions, and any other deductions your employer might take out. So, while you start with $43 an hour, your take-home pay can be a lot less once those things come into play. So, be sure to keep that in mind when you’re lookin’ at your paycheck each week.

It’s also important to remember that if you’re self-employed or workin’ as a contractor, you might have to pay more in taxes. Folks who work for themselves gotta pay both the employer and the employee portion of Social Security and Medicare taxes, which can make their tax rate higher than someone workin’ a regular job.

Is $43 an Hour a Good Wage?

Well, that depends on where ya live and what your expenses are. In some places, $43 an hour is a decent livin’, but in bigger cities, it might not go as far. Rent, food, and healthcare can eat up a big chunk of your paycheck, so ya gotta think about where you’re livin’ when you’re considerin’ if $43 an hour is good money. But overall, for most folks, it’s a fair wage, especially if you’re able to work full-time and don’t have too many expenses pullin’ at your paycheck.

Conclusion

So, to sum it up, if you’re makin’ $43 an hour, you’re lookin’ at around $89,440 a year before taxes if ya work full-time all year. After taxes, though, you might take home around $66,000, dependin’ on your tax rate. It’s a good wage, but keep in mind that taxes and other deductions can take a big chunk outta that. And, like I said before, if ya work less than full-time, your numbers will be lower. But overall, $43 an hour is not too shabby, especially if you live in a place where the cost of livin’ is reasonable.

Tags:[hourly wage, $43 an hour, annual salary, after taxes, income calculation, tax rate, full-time salary]